Nothing in the world is certain “except death and taxes.” Benjamin Franklin wrote that famous line back in 1789.

Jump to 2017 and you’ll find another certainty: Taxes in Canada are set to rise over the next few years.

The 2017 Federal Budget was released on March 23. And to the relief of many, it wasn’t as bad as expected. Many experts were predicting higher taxes, especially for high-income earners.

But the tax hike never happened. In fact, not much happened at all. The 2017 budget was such a non-event, many are calling it the “wait and see budget.”

So what happened?

Download our report The Biggest Reason Why Pharmacists Pay Too Much Tax

- Big government deficits: The Liberal government is committed to investing in Canada’s future. To pay for this investment, the government plans on running deficits over the next five years (and beyond). The 2017-18 deficit alone is $28.5 billion. So the question becomes: When will the government start to balance the books again? (a.k.a. When will taxes go up?)

- Donald Trump in the White House: President Trump plans to Make America Great Again with tax cuts and deregulation. That’s a big contrast to Trudeau’s plan of big deficits and increased government intervention. If Canada becomes less attractive to business relative to the USA, it will impact everything from the Canadian Dollar to the investments in our RRSPs.

- Rising housing costs: Skyrocketing housing prices in Canada is making it difficult for many first-time home buyers. Some experts say the government needs to step in. Possible ideas include lending restrictions, changing the capital gains exemption, even banning foreign buyers.

Instead of tackling these issues head on, the federal government decided to take a wait and see approach with the budget. In politics, they call that kicking the can down the road.

But this strategy only works for so long. Eventually the government will have to make some tough decisions regarding the realities of today.

What does the 2017 budget ultimately mean for Canadians?

From my perspective, all the evidence points to one outcome. I rarely make predictions, but I will say this: Expect some major changes to your tax bill over the next few years.

Sure, the investments being made by the Liberals are meant to grow the economy and shrink the burden of the deficits. But even the best case scenario will not eliminate the deficit burden. Higher taxes will have to make up the difference.

Sorry…

I know nobody wants to hear that taxes are going up. But before you shoot the messenger, I do have some good news.

The recent wait-and-see budget is giving us a rare opportunity to plan before rates actually go up.

Now is the perfect time to do some tax planning!

Higher taxes may be on the horizon. But a good plan during this window of opportunity could help you save thousands of dollars down the road.

All Pharmacists need a good tax plan

I know how hard pharmacists work. So a big part of my job is to help them keep more of what they earn.

Now don’t get me wrong. I’m not an anti-tax guy. In fact, I think our tax system helps pay for many things that make Canada great: health care, education, infrastructure etc.

But everyone should pay their fair share of taxes and no more.

Pharmacists pay a big chunk in taxes, maybe more than their fair share. That’s why I do a lot of tax planning. A good tax plan helps clients take advantage of all the opportunities available to them.

Some professionals call tax planning the “tax game.” I like that analogy. Why? Because there is a playing field out there. And it’s certainly not level. Let me give you an example:

If you miss a big deduction when filing your taxes, it’s unlikely that a person at the tax office will correct the mistake to give you a bigger refund.

But if you miss claiming all your income, a person at the tax office might show up at your door!

The goal is not to grind your taxes down to zero using Swiss banks and offshore accounts (that kind of stuff will land you in jail). I’m simply talking about using all the fair tax strategies that are available to you.

Tax planning? Doesn’t my accountant do that?

Many people think their tax professional already does planning for them. That’s likely not the case. The confusion comes from equating tax filing to tax planning.

Tax filing involves collecting receipts, filling out forms and submitting your return. On the other hand, tax planning involves looking at your future tax situation to identify opportunities.

So what’s the difference?

Tax filing is generally a reactive process: Once the tax season starts, you give your receipts to your tax person, and they look for ways to trim your tax bill for that year.

Tax planning is generally a proactive approach: You look into the future to see if there are any long-term strategies you can benefit from.

Most accountants only look at your the current tax year. So if you want to save tax this year, an accountant is the best person for the job.

But some tax strategies stretch out over several years. You need a long-term perspective to see those opportunities. That’s where tax planning comes in.

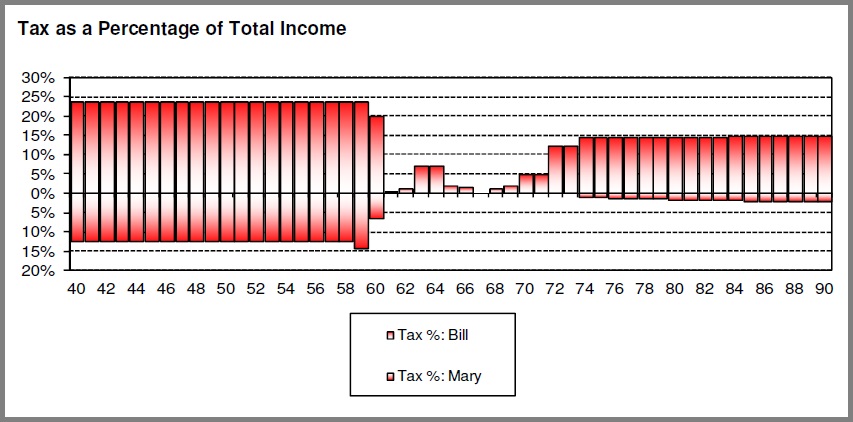

The graph below is part of the tax review I do for clients. It provides a long-term projection of a client’s tax situation.

In this example, Bill and Mary are in a very low tax bracket starting at age 61. So a good strategy would involve bumping some income into these low tax years.

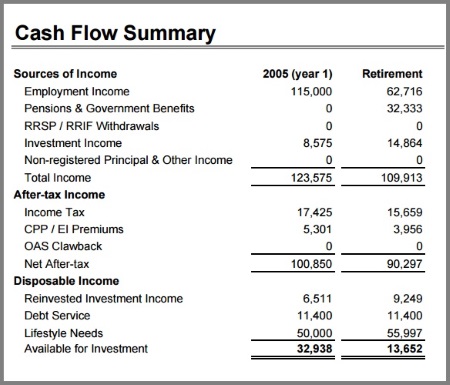

Here’s another example that should make you feel better about retiring one day. The graph below is a tool I use that looks at your cash flow before and after retirement.

Many people worry about loosing their pay cheque when they retire. In this example, Mary retires early and the couple’s income is cut by half.

Sure your income goes down in retirement. But there’s a flip side: income taxes, EI and CPP payments go down, too. Remember, it’s all relative people!

Three Steps to a Solid Tax Plan:

So have I convinced you that a tax plan is important? Great!

Now let’s look at how you can create a tax plan for yourself. Whether you work with a professional, or do things on your own, a good tax plan should include these three steps:

#1: Visualize your career and personal life: The first step is to think about where you are headed over the next few years. This includes looking at your career and personal life. I recommend looking out three years.

Why three years?

Like all forecasts, there’s an element of guess work involved in trying to predict the future. The further out you go, the less accurate you’ll likely be. I’ve found that focusing on the next three years is a good medium.

So what kind of things should you consider? Here are some questions that can help you along:

Your Career:

Are you close to a promotion?

Are you expecting a bonus?

Are you thinking about retiring?

Your Life:

Will you get married?

Will you buy a house?

Will you take a parental leave?

#2: Consider the tax implications you may encounter: Once you have an idea of where your life and career are headed, start to think of the tax implications that might follow.

For example, a job change might allow you to make new tax deductions. Your personal life might open up some tax splitting opportunities.

Continuing with the example above, here are some tax implications to the previous questions:

Your Career (with Tax Implications):

Are you close to a promotion? (Will I be able to claim my mileage now?)

Are you expecting a bonus? (Can I put my bonus directly into an RRSP?)

Are you thinking about retiring? (What will my tax bracket be when I retire?)

Your Life (with Tax Implications):

Will you get married? (How will my new marital status affect my taxes?)

Will you buy a house? (Should I use my RRSP for the down payment?)

Will you take a parental leave? (Can I defer some income into this low tax year?)

As you can see, your career and life path have many tax implications. Listing them will help you sketch your tax plan.

#3: Plan your strategy: The final step is to choose your tax moves. Some decisions are obvious, but others are tricky. Taxes can get complicated real fast, so don’t hesitate to bring in a professional if you run into difficulties.

A good plan could save you hundreds, if not thousands of dollars. So a good tax professional is usually a great investment.

Conclusion:

Not much happened in the 2017 Federal Budget. But there’s no time to be complacent. Higher taxes are on the horizon, so you need to act.

The Liberals have given us a short window of opportunity to do some important tax planning. Are you going to take advantage of it?

About the Author:

Paul Carvalho helps pharmacists in Canada with investments, life insurance and retirement planning. He has a Bachelors Degree in Economics, a Masters Degree in Business Economics, and has earned the Chartered Financial Analysis (CFA) designation.