Many people set financial goals at the beginning of the year. And if you’re like most pharmacists I know, saving for retirement is a big priority.

Whatever your goals are, it’s important to have a plan to make them a reality.

And if saving for retirement is on your to-do list, this is the perfect place to be!

I’m a financial advisor who specializes in helping pharmacists. Keeping pharmacist retirement plans on track is a big part of what I do. So I know what it takes to achieve success.

Here’s the best part: I’m going to share my success secrets with you!

I’ve discovered ten tips pharmacists can use to keep their retirement plans on track. So if you’ve been saving for a while, or just starting out, these tips will help stay on course.

Sound good? Let’s go!

Is retirement possible for today’s pharmacists?

Before we start, some of you might be wondering: Is retirement even possible for me?

Absolutely!

The pharmaceutical industry continues to change at warp speed. And this constant change has stressed out a lot of people.

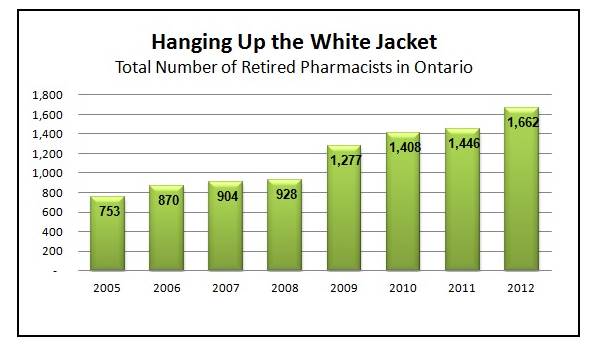

But retirement is possible. In fact, more and more pharmacists are retiring every year.

Source: Ontario College of Pharmacists

The difference today is that pharmacist retirement plans require new strategies. So the destination is the same (i.e. your golden years) but the road to get there is quite different.

And like any journey, the key to getting there is to have a map.

Which brings us to tip #1:

1) Have a written retirement plan.

The first step to retirement planning is defining your goals. After all, how do you know if you’re on track if you don’t know where you’re going?

According to a new CIBC poll, nearly half (46 per cent) of Canadians do not have a financial plan in place, even though many people feel concerned about their retirement years.

If you don’t have a plan, now is the time start. Don’t worry: It’s not all hard work.

Have some fun. Do some daydreaming.

Start off by asking yourself: “What would I do with my time if I never had to go back to the pharmacy again?”

- Would you travel the world or spend more time at home with your family?

- Would you take up bird watching or become a member at an exclusive golf club?

- Would you do volunteer work or start a side business?

Questions like these help you create a mental picture of your retirement. More importantly, write it all down. This will make your goals more concrete and more likely to be achieved.

After you’ve defined your retirement goals, the next step is to to look at some numbers. For example, spending more time with your family is cheap. Cruising the Mediterranean every year for a month is not.

A good financial advisor can help you translate your goals into a useful pharmacist retirement plan. There’s also some good retirement calculators available online to help you crunch the numbers.

2) Build around your pension plan.

Many pharmacists have employer pension plans, so you need to include them in your plans. The type of pension you have will impact how you build the rest of your retirement plan.

Most hospital pharmacists have a defined benefit (DB) pension plan. Most retail pharmacists have a defined contribution (DC) pension plan.

A DB pension plan means your employer promises to pay you an income for the rest of your life when you retire. The more years you work, the bigger your pension cheque becomes.

A DC pension plan means your employer gives you a dollar amount each year, and that money is invested on your behalf. The more years you work, the more money goes into your retirement account.

In Canada, pension plans are a hot button topic. Some people are adamant that DB plans are better than DC plans (i.e. getting a monthly cheque is better than having money deposited into an account). I say that’s not true.

No pension plan is perfect, and both plans have their pros and cons. The bottom line is that both types of plans can help you achieve your retirement goals.

A good pharmacist retirement plan should build around the type of pension plan you have.

So hospital pharmacists will likely have a DB pension at its core. Retail pharmacists will likely have a DC plan at its core.

3) Use tax advantaged plans like RRSPs and TFSAs.

Tax advantaged plans like RRSPs and TFSAs are great savings tools for pharmacists. You need to use them to their fullest advantage.

Registered retirement savings plans (RRSPs) make a lot of sense for pharmacists. Why? Because most pharmacists are in a high tax-bracket.

Contributing to an RRSP plan reduces your taxable income and lowers your tax bill for the year. The drawback is you need to pay taxes when you take money out of your RRSP. But if you plan things right, you’ll be in a lower tax bracket when you start to draw on your RRSP.

Tax free savings accounts (TFSAs) are also great for pharmacists. You don’t get a tax reduction when you make a contribution to a TFSA. But your savings grow tax-free while in the account, and there’s no tax on any withdrawals.

4) Consolidate plans from any previous employers.

Pharmacy has certainly changed from a generation ago. Gone are the days when a pharmacist would work their entire career for one employer. Today’s pharmacists are likely to have three or more employers over their careers.

As a consequence, you’ll likely accumulate several saving accounts from different employers. These “orphan accounts” can create a lot of problems:

- you might lose track of your money

- the investments might not be suitable anymore

- the beneficiary designation might be out of date

When moving to a new job, merge your old accounts in one place. Moving retirement accounts can almost always been done without incurring tax.

So if you have multiple RRSP accounts, merge them into one account. If you were part of a group pension plan, use a locked-in retirement account (LIRA) to move the money into an account in your name.

Saving Strategies

5) Start early to increase the power of compounding.

Pharmacists know all about compounding! Right?

Sorry. I’m talking about a different kind of compounding…

When it comes to saving, compound interest is a powerful force. Compounding happens when earnings on your money starts to generates earnings of its own. It’s like a bonus for starting to save sooner rather than later.

Pharmacists can leverage the power of compounding by saving as early as possible. Even saving a small amount can have a dramatic effect on how much you accumulate at retirement.

The phrase “Get your money working for you.” is related to compound interest. It means that after a while, your money will start to grow on its own, rather than you having to dump more money into your account.

So if you start early enough, your money will do most of the saving for you through compound interest.

If you start late, you’ll have to do most of the saving yourself (… by working longer as a pharmacist doing that other type of compounding).

6) Take advantage of employer matching.

Who doesn’t like free money?

Many employers offer savings plans with a company match. Examples include group retirement plans, RRSP plans and stock purchase plans. Employers generally match contributions up to a certain percentage or dollar amount.

If possible, contribute enough to maximize the employer’s match. The extra money from your employer can add up over time and help you build your retirement savings.

I’m amazed at how many people I meet who don’t take advantage of this perk. (This is free money people!)

7) Get your raise or bonus working for you.

Okay. I understand.

Pharmacy hasn’t exactly been a cash bonanza lately. Pharmacist raises and bonuses have been few and far between.

But things are starting to improve, so the cash is starting to flow again.

It’s important to have a plan for that extra cash. As we’ve seen, even a small increase in your savings can have a dramatic impact on your final nest egg.

Portfolio Strategies

8) Understand market volatility and long-term performance.

If you want your savings to grow, you need to invest a chunk of your money in the stock market. Stocks have historically outperformed bonds and cash over the long term.

Over 50 years in Canada, here are the average annual returns for stocks, bonds and cash:

- Stocks: 9.3%

- Bonds: 6.0%

- Cash: 2.8%

** Average annual returns for 50 years ending July 31, 2015. Source: CI Investments

Now before you sink all your money into the stock market, you need to understand one thing: Stock market returns are volatile!

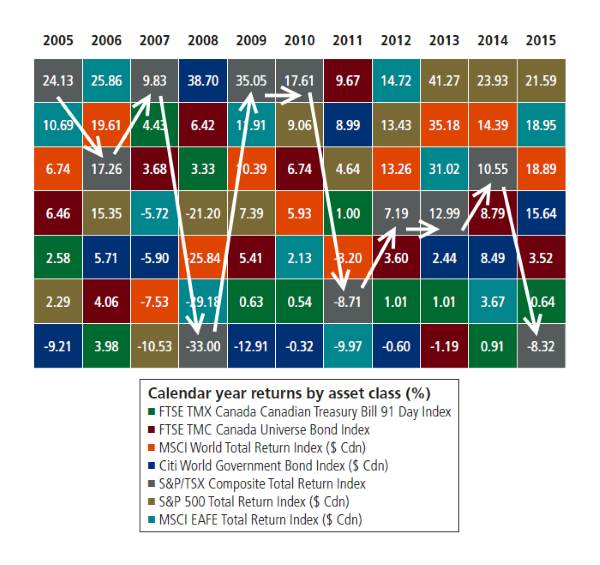

In fact, stocks can be very volatile in the short term. Here’s another perspective: Let’s scrap the averages and look at the year-to-year stock market returns.

[table caption=”S&P/TSX Composite Index Total Return” width=”300″ colalign=”center|center”] Year, Return (%)2015,-8.32

2014,10.55

2013,12.99

2012,7.19

2011,-8.71

2010,17.61

2009,35.05

2008,-33.00

2007,9.83

2006,17.26

[/table]

Hey… Where did that 9.3% return on stocks go? Great question.

Sure the average returns look great. But on a one-year basis, the historical returns on the S&P/TSX Composite range from minus 35% to plus 40%. Talk about volatility!

That’s why you should always invest in the stock market for the long term.

Looking at the table, you can see the risk of jumping in the stock market for only one year. In this sample, you would have lost money three out of ten years if you invested for only one year.

But the negative years are usually followed by positive years. So you can reduce the chance of a loss if you stay invested longer than one year. And if you stay invested for a really long time, the chances of achieving the long term averages on the stock market are greatly improved.

9) Diversify.

Even though stocks outperform over the long run, most people need to diversify their savings. Why? Because the stock market is too volatile for most people.

Again, long term averages look great. But humans live from day to day. So it’s natural for us to watch our savings every step of the way.

When it comes to money, we sometimes act irrationally. Long term averages are meaningless if we abandon our plan at the first sign of trouble.

Diversification is a strategy that helps you stay committed to your long term game plan. Diversification means holding more than one type of investment, like stocks, bonds and cash.

Not all investments react the same to changing economic conditions. So a diversified portfolio reduces volatility. The top performing investment in one year can be the worst performing investment in the following year.

Having the right mix of investments will protect you from a major downswing in any one investment. It will also keep you on track toward your long-term goals.

10) Rebalance your portfolio.

Over time, different investments will produce different returns. So your portfolio might drift away from the investment mix you chose for yourself. That’s why you should review your portfolio regularly to see if it’s still invested according to plan.

When your investment mix drifts away from its original target, you should rebalance back to your long term plan. That means buying and selling certain investments to get back to their targets.

The beauty of rebalancing is that it forces you to adopt the golden rule of investing: buy low, sell high.

For example, if the stock portion of your portfolio has grown significantly, rebalancing will force you to sell some stocks. This in turn will force you to buy some more under performing investments. This is the definition of buying low, selling high.

When the investment rankings rotate (like we’ve seen in the table above), your portfolio will be in a good position to benefit.

Conclusion:

Pharmacists today have a lot of new tools to help them prepare for retirement. But the key is to have a good plan. Think of your retirement plan as your prescription for success (…sorry, I couldn’t resist).

Retail pharmacists and hospital pharmacists need to focus on different things, so they need to plan accordingly. But the designation for all pharmacists is the same: hanging up the white jacket for good. A good map will get you there.