Despite all the recent talk of low savings rates, high debt levels and the slow death of company pension plans, a large number of pharmacists have done what many today think is impossible: retire.

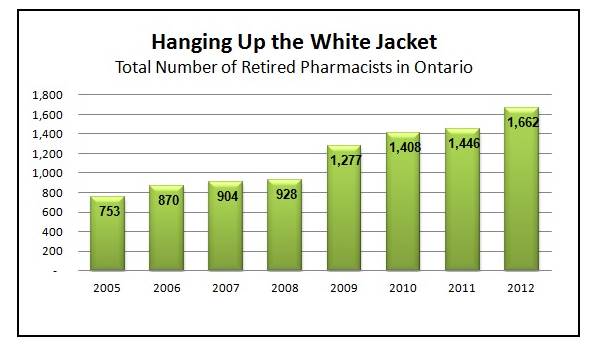

According to the Ontario College of Pharmacists (OCP), the number of pharmacists in Ontario who are retired or no longer working rose from 928 in 2008 to 1,662 in 2012: an increase of almost 80% in four years.

For those pharmacists who are anxious about their financial future, the good news is that retirement is absolutely possible! However, today’s road to retirement is significantly different than the one travelled by previous cohorts.

The Canadian pharmaceutical industry has changed dramatically over the last few years, so pharmacists working today need to employ new tools in order to secure their retirement years.

Retirement is absolutely possible for today’s pharmacists.

One trend will likely continue in the future: The burden of retirement planning will fall increasingly on the shoulders of individuals.

Gone are the days when government and employer pensions would fund the bulk of an employee’s retirement. So it’s especially important today for individuals to take an active interest in making make sure their finances are on track.

Whether you work closely with a financial advisor, or manage things yourself, everyone should have a retirement plan that focuses on three fundamental areas: your net worth, cash flow and taxes.

Your Net Worth

Every profession uses certain key metrics to measure results. For example, doctors use blood pressure and cholesterol levels to assess a patient’s physical health. To determine your financial health, a key measure to look at is your net worth.

Your net worth is calculated by adding all your assets (what you own), then subtracting all your liabilities (what you owe).

Many assets like cash, investments, and real estate are obvious and easy to add up, but some assets are not so obvious (like the dollar value of certain pension plans).

Likewise, many liabilities are obvious (credit card debt, mortgages), but some liabilities are hidden. One example of a hidden liability is the taxes owed when RRSPs are cashed in.

The way to improve your net worth is to grow your assets, reduce your debts, or a combination of both. A healthy financial plan will show a consistent increase in your net worth.

Cash Flow

A good salary alone does not guarantee financial success. It takes a little discipline and planning to create a financially secure future.

Creating a budget is the best way to monitor where your hard earned money is going. A budget will highlight your current expenses and the expenses you expect to have in retirement. This will give you an idea of what your saving goal should be. A good budget also increases the odds of achieving your savings target.

Taxes

Taxes are by far the biggest expense for most pharmacists, so a good plan will have tax management as a cornerstone.

There are many strategies that can greatly reduce the incidence of taxation for pharmacists. Some tax strategies focus on employment income (i.e. incorporation), while other tax strategies focus on investment income (i.e. TFSAs, RRSPs). There are also estate considerations (i.e. the use of trusts).

Final step: Take action

The last issue a good plan should address is financial inertia. A recent study from Standard Life shows that over 40% of Canadians are very concerned with their finances, but certain behavior pitfalls are preventing many people from taking action.

All financial plans should have an action plan with specific target dates. This will keep you focused, motivated and moving along the path to your long-term saving and investing goals.

About the Author:

Paul Carvalho helps pharmacists in Canada with investments, life insurance and retirement planning. He has a Bachelors Degree in Economics, a Masters Degree in Business Economics, and has earned the Chartered Financial Analysis (CFA) designation.