I was excited to hear that a Canadian won this year’s Nobel Prize in physics. Arthur McDonald from Queens University, along with Takaaki Kajita of the University of Tokyo, won the award for their experimental work on neutrinos. Neutrinos are tiny unseen particles that zip back and forth through the universe at close to the speed of light.

Like physics, personal finance also has an element that’s invisible to the naked eye: your knowledge capital.

Most of us are familiar with the basic building blocks of a portfolio: stocks, bonds and cash. By choosing the right mix of these three elements, investors can create a financial plan that can help them achieve their financial goals. But one of the most overlooked asset classes, especially with young and middle-aged pharmacists, is your knowledge capital.

As I explained in a previous post, your knowledge capital (sometimes referred to as earnings potential) is your ability to sell your time for a fair a wage. The younger you are, the more relative time you have to sell, the bigger your knowledge capital is.

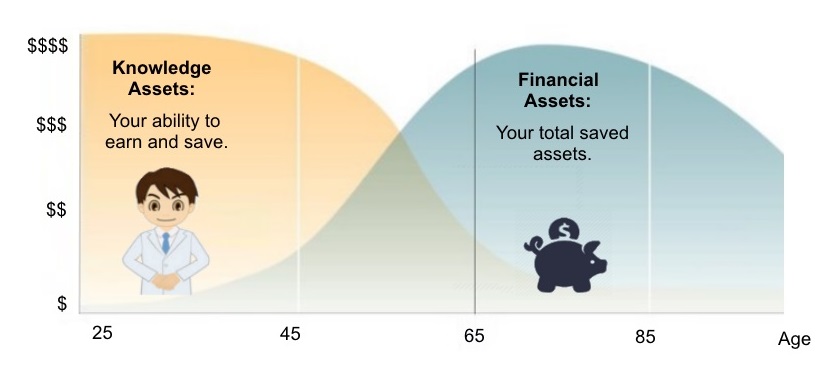

Knowledge Assets vs. Financial Assets:

Using this logic, you can see that young pharmacists have large amounts of knowledge capital when they start their careers, but very little financial assets. As you start to earn an income, you begin to pay down your debts and eventually start saving.

Using this logic, you can see that young pharmacists have large amounts of knowledge capital when they start their careers, but very little financial assets. As you start to earn an income, you begin to pay down your debts and eventually start saving.

Over time, your knowledge capital and financial assets go in opposite directions. Essentially, most professionals are engaged in a lifelong process of converting their knowledge assets into financial assets.

What does this have to do with my finances?

One of the reasons this website keeps close tabs on pharmacist salaries (i.e. the Pharmacists Salary Report) is because we use it to calculate a pharmacist’s total wealth. By having a good estimate of what pharmacist wages are today and what they look like tomorrow, we can estimate the dollar value of that important invisible asset – your knowledge capital.

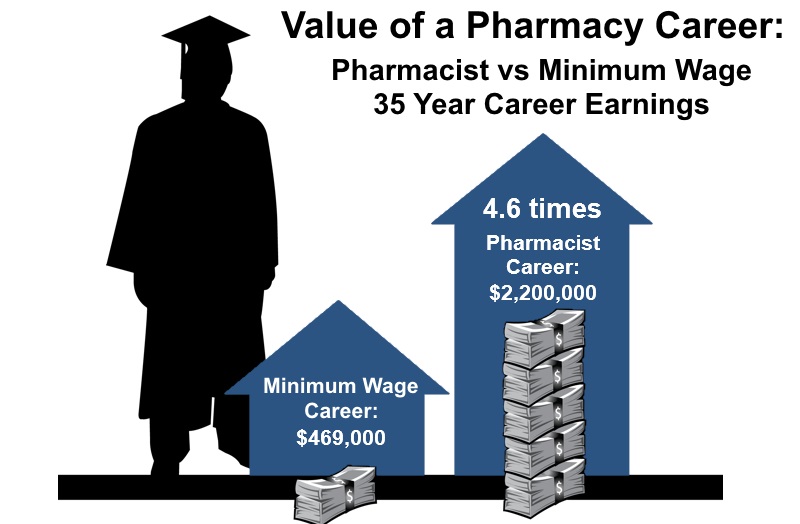

Having this information is extremely useful. First, we can check if a pharmacy degree is still a good investment.

The average pharmacist in Canada can expect to earn $2.2 million dollars over a 35 year career.

For example, the average pharmacist in Canada can expect to earn $2.2 million dollars over a 35 year career. Compare that to the $469,000 accumulated after 35 years of working for minimum wage. As you can see, the cost of a pharmacy degree is still an excellent investment over the long-term.

Also, having an estimate for your knowledge capital can help you build a better investment plan that keeps you focused on the long-term. For example, a 45 year-old pharmacist with a $200,000 portfolio will see a $40,000 paper loss if the market goes down 20%. But knowing that they still have over $1.7 million in future earnings can help them stick to their long-term plan that will lead to a likely recovery.

Protecting Your Knowledge Capital

Of course, there are no guarantees in life. Keep in mind that your knowledge capital is contingent: You still have to get out of bed and go to work if you want to covert your time into a pay check. Your knowledge capital is also exposed to three risks that pharmacists should protect themselves against: death, disability and professional competency.

Pharmacists with young families should protect their knowledge capital with life insurance. This is especially true for families with large future financial obligations like mortgages or children’s education costs. If a young pharmacist unexpectedly dies early in life, he or she is denied the opportunity to convert their knowledge capital into financial assets.

A life insurance policy pays the family a death benefit in the event of death, to compensate the family for the lost earnings. Term life policies are cost effective policies that protect against this type of risk.

Similarly, pharmacists should protect themselves against illness and disability that could prevent them from earning an income. Many pharmacists have disability polices included in their company benefits plans, but these plans usually protect only a small portion of income. In many cases a top-up policy is required for full coverage.

Finally, your ability to earn a future wage depends on your professional competency. Constant change in the pharmaceutical industry is becoming the new norm, so pharmacists need to protect their careers against complacency. Committing to life-long learning and keeping current with industry trends (an easy way to keep current is to subscribe to the Pharmacists First email list!) is the best way to protect against this risk.

The Bottom Line:

Young and middle-aged pharmacists need to keep their knowledge capital in mind when planning their financial future. It’s a significant asset that needs to be both protected (with life and disability insurance) and nurtured (with life-long learning).

As famed investor Warren Buffett once said, “The best investment you can make is always in yourself.